If you're looking for an Indianapolis financial advisor, you've come to the right place. Castle Investment Advisors, which is registered with the SEC, focuses on managing personal assets, charitable trusts and retirement funds. Private family foundations are also included. Castle Investment Advisors also has a separate division called Castle Valuation Group that prepares business valuations, for both publicly and privately owned companies. Whether you're planning for retirement or looking to sell your business, Castle Investment Advisors is here to help you navigate the changes.

Fiduciary financial planners put clients' interest before their own

A fiduciary financial advisor is a financial advisor who puts the best interests of their clients first. Fiduciaries follow strict legal guidelines. The companies they recommend do not pay them any compensation. This ensures that their advice is objective and free from conflicts of interests.

Your fiduciary financial advisor will make sure that you have the best possible investments. Their goal is to protect your interests, so they won't make any recommendations without you consent. Fiduciary advisors can help you make the right investments, balance your portfolio and give you peace of mind.

Senior financial advisors

A senior financial advisor can help seniors with their money and prevent them from falling victim to fraud. You need to find the right advisor to meet your loved one's financial goals. The goals of a senior who is looking to increase retirement savings are often different than those who are more concerned with carefully managing their existing nest egg.

Many Indianapolis companies offer senior advisor services. CFG Wealth Management Services is one example. CFG Wealth Management Services, an Indianapolis-based firm, offers its clients retirement planning, investment management and education services. The firm's staff has more than 30 combined years of experience in asset management, retirement planning, and investment management. Each of its advisors is a certified financial planner.

Advisors charged a nominal fee

An Indianapolis-based fee-only financial adviser can be a great option for your financial planning. These advisors offer services including investment management, tax planning, retirement income planning, and more. These independent fiduciaries earn their compensation directly from clients. This eliminates potential conflicts of interests that could arise from commission-based arrangements.

Fee-only Indianapolis financial advisors are charged based on the fiduciary. The fees charged by these advisors range from a $1,000-$2,000 one-time fee to an hourly rate of $200-5500. You may also need to pay a $100-$1000 monthly retainer fee for asset management. Some advisors charge a commission on certain products, or a percentage from the portfolio's overall value.

Costs of working with an advisor financial advisor

It is up to you to decide what kind of financial advisor you want. The costs of Indianapolis financial planning can vary greatly. However, there are a few things you should keep in mind when deciding which adviser to choose. First, make sure you ask if the adviser is charged a fee. This will ensure you receive advice that is in your best interest. Additionally, a fee-only financial advisor is less likely to push unnecessary products on you.

Next, consider whether advisors are fiduciaries. This means that they are legally required to look out for the best interests of their clients. Fiduciaries are not paid by companies that they recommend. They only get compensated for recommending products in your best interests.

FAQ

What kind of contracts can consultants sign?

Most consultants sign standard employment agreements when hired. These agreements outline how long the consultant will work for the client, what he/she will get paid, and other important details.

Contracts may also include details about the specific areas of expertise that the consultant is going to be focusing on as well as how they will be compensated. A contract may state that the consultant will deliver training sessions or workshops, webinars, seminars and other services.

Sometimes, the consultant agrees to do certain tasks within a given time frame.

Many consultants sign independent contractor arrangements in addition to standard employment contracts. These agreements allow the consultant not only to work for himself/herself but also provide payment.

How long does it take for a consultant to be established?

Your industry and background will determine the length of time it takes. Most people start with just a few months of work before finding employment.

However, some consultants spend several years honing their skills before finding work.

Which industries employ consultants

There are many different types. Many consultants specialize in a particular type of business. Others may be more focused on multiple types.

Some consultants work exclusively for private businesses, while others represent large corporations.

And some consultants work internationally, helping companies all over the world.

Why would a company want to hire a consultant for their business?

Consulting provides expert advice about how to improve your business performance. Consultants are not here to sell products.

A consultant is a person who helps companies make better choices by providing sound analysis, and making recommendations for improvement.

Consultants often work with senior management to help them understand how to succeed.

They offer coaching and leadership training to help employees achieve their highest potential.

They can help businesses reduce costs, streamline processes, and increase efficiency.

Statistics

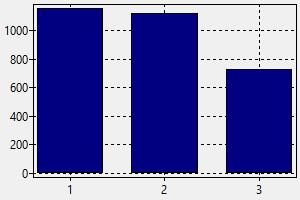

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

External Links

How To

How to start a consulting company and what should I do first?

It's a great way for you to make money online by starting a consulting company. You don't need any previous business experience or investment capital. To start your own consulting business, you can build a site. Once you've built a website, you'll want to use social media platforms such as Facebook, Twitter, LinkedIn, Instagram, Pinterest, YouTube, etc... to get the word out about your services.

You can create a marketing strategy that includes these things with these tools

-

Create content (blogs).

-

Building relationships (contacts).

-

Generating Leads (lead generation forms).

-

Selling products through ecommerce websites

Once you have created your marketing strategy you will need to find clients that will pay for it. While some people prefer to attend networking events and groups, others prefer online methods like Craigslist, Wikijiji, or Kijiji. The decision is up to each individual.

After you have found new clients, it's important to discuss terms and payment options. You can discuss hourly rates, retainer agreements, flat fees, and other options. Before you accept a client, you need to know what you expect so that you can communicate clearly all through the process.

An hourly contract is the most popular type of contract for consulting services. You agree to offer certain services at a fixed fee each month or every week. Depending on the type of service you are offering, you may be able to negotiate a discount depending on the length of the contract. When you sign a contract, make sure you fully understand it.

Next, create invoices for your clients and send them. Invoicing can be a complicated task until you actually attempt it. There are many options for invoices to be sent to your clients. For example, some people prefer to have their invoices emailed directly to their clients, while others print hard copies and mail them. Whatever your preferred method, make sure it works well for you.

After you've finished creating invoices, you'll want to collect payments. PayPal is preferred by most because it is easy-to-use and offers multiple payment options. Other payment processors such as Square Cash. Google Wallet. Apple Pay. Venmo.

Once you're ready for collecting payments you'll need to set up bank account. Separate savings and checking accounts will allow you to track your income and expenses independently. When paying bills, it is also beneficial to set up automatic transfer into your bank account.

Although it can seem daunting when you first start a business as a consultant, once you get the hang of it, it will become second nature. This blog post will provide more information about starting your own consultancy business.

Starting a consulting firm is a great way to earn extra cash without worrying about employees. Many consultants work remotely. This means that they don’t have to deal in office politics or work long hours. Being able to work remotely allows you more freedom than traditional employees.